IMRO Distribution Policies

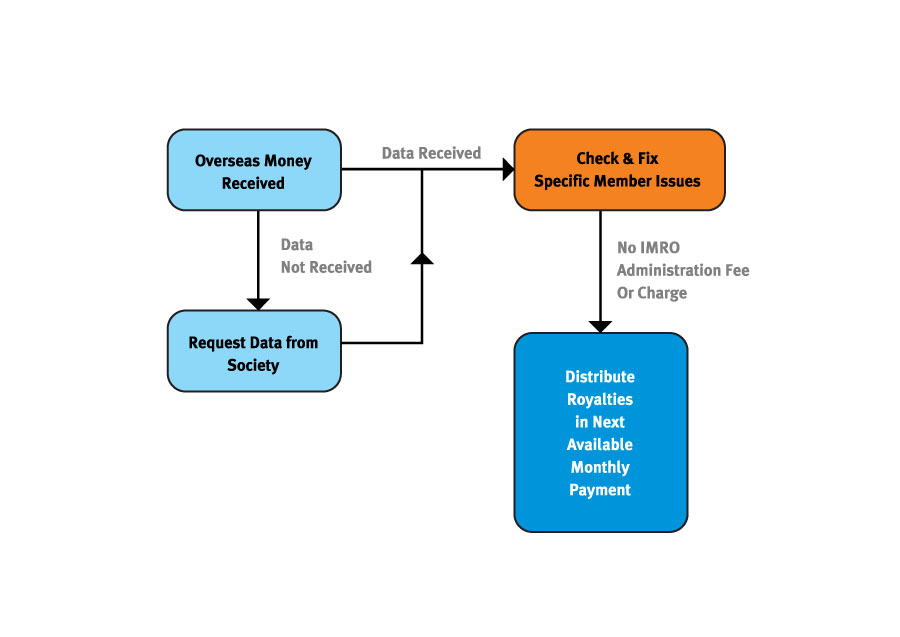

One major advantage of choosing IMRO for music creators is that IMRO doesn’t impose additional administration charges on overseas public performance royalties. Unlike many other performing right organisations, which typically deduct fees ranging from 2% to 8% from overseas royalties, IMRO believes that local performing rights organisations have already handled this, so its members are not subjected to double charges.

IMRO stands out for its efficient royalty payment system, providing members with monthly payments for overseas royalties, invoiced live performances, unmatched performances, and adjustments. This frequency is far more frequent than the quarterly or less frequent payments offered by most other societies. Members can easily access their royalty statements through an online portal on the IMRO website, which uses cutting-edge cloud-based technology.

-

- 1 Introduction. 5

- 2 Broadcast Royalties. 7

- 2.1 Television. 7

- National Television – General8

- National Television – Advertising. 8

- Local/Cable Television. 9

- Cable Re-Transmission. 9

- 2.2 Radio.

- National /Quasi- National Radio – General11

- National /Quasi- National Radio – Advertising. 12

- Regional /Independent Local Radio – General12

- Regional /Independent Local Radio – Advertising.

- Digital Radio. 21

- Community Radio. 22

- 3 Cinema Royalties. 23

- 3.1 Cinema – Mainstream.. 23

- 3.2 Cinema – Arthouse. 23

- 3.3 Cinema Advertising. 24

- 4 Live Royalties. 25

- 4.1 Invoiced Live Events. 25

- 4.2 Tours & Residencies Scheme. 26

- 4.3 Live Music Survey. 27

- 4.4 RTÉ Performing Groups. 28

- 5 Background Music. 29

- 5.1 Public Reception. 29

- 5.2 Background Music – Recorded Music. 30 30

- 5.3 Sports Stadia

- 5.4 Airlines

- . 316 Digital Royalties

- 6.1 Music Downloads

- 6.2 Ringtones

- 6.3 Music Streaming

- 6.4 Video Streaming

- 7 Royalties from Overseas

- 8 International Standards

- 8.1 Inadequate Documentation

- 8.2 Unidentified Performances

- 8.3 Unidentified Commercials

- 8.4 Debit/Credit Adjustments

- 8.5 Suspense Amounts

- 8.6 Duplicate Claims/Dispute Works. 36

1 Introduction

This document provides an overview of how IMRO distributes the royalties it collects on behalf of composers, authors and publishers. IMRO collects royalties from a range of sources and this document explains in detail how and when the royalties from each source are paid to the copyright owners.

This document should be read by IMRO’s members, IMRO’s affiliates (performing right societies outside of Ireland with whom IMRO has a reciprocal agreement) and IMRO’s customers and is intended to make IMRO’s royalty distributions as transparent as possible.

To make a distribution IMRO needs 2 key components

- Royalty: The revenue collected from licensed users of music

- Data: Information related to the music usage by the licensed user

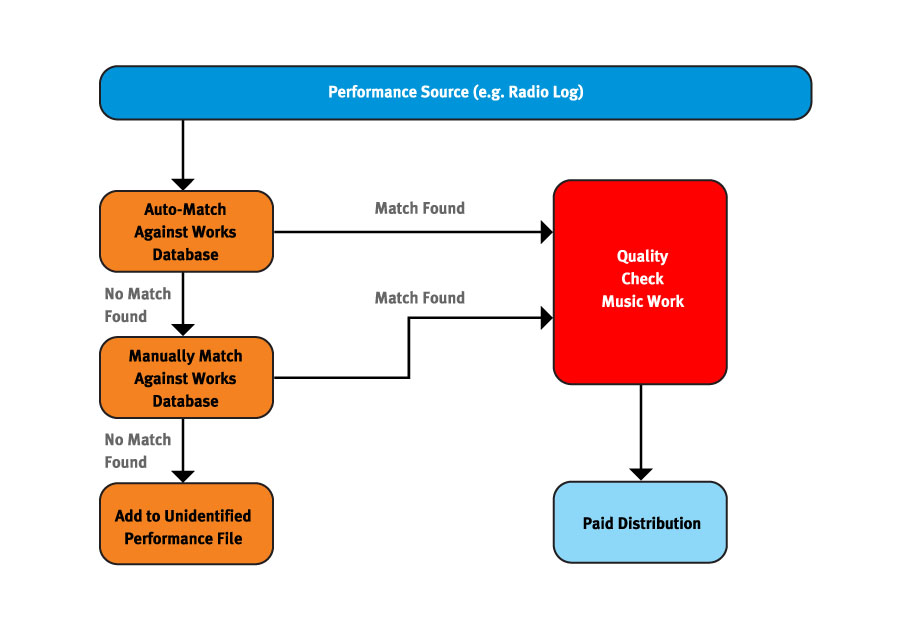

Under the terms of IMRO’s license agreements, many of IMRO’s customers are obliged to report to IMRO the musical works that they have used e.g. played on radio or at a live concert etc. These lists are brought into IMRO’s Distribution System and matched against the almost 22 million works held on IMRO’s database. IMRO then uses this information together with information provided by its members, affiliate societies and third parties to identify the copyright owners of each musical work used and to calculate the royalties due.

Wherever economically feasible, IMRO tries to ensure that the royalties received from each customer are paid directly on the basis of the musical works performed or broadcast by that user. Through the increase of electronic reporting from customers and the implementation of a new Distribution System, IMRO are processing ever increasing amounts of data in a cost-effective way. However, in some cases, the cost of processing the data will exceed the level of royalties collected; IMRO therefore uses a combination of techniques to distribute royalties.

Data Analysis

Census

When distributions are carried out on a census basis it means that the royalties received from an individual customer are distributed 100% across the music used and reported by that customer. Most television and radio station royalties are distributed this way.

Census/Sample

Some radio stations play most music from a ‘play-out’ system; however they will often have a range of specialist programmes that are returned manually. If a station’s royalties are distributed on the Census/Sample rate, it means that they are delivering full census reports for all automated programming (i.e. where music is played out using an automated/play-out system) and are on a sample rate for all programming not delivered via an automated system (i.e. incorporating specialist programming).

Sample

This is where royalties from an individual customer are distributed using a representative sample analysis of its logs. All sample data is chosen on a random basis using a software tool.

Analogies

Royalties for most performances given by recorded means (CD, juke boxes, background music devices etc.) are distributed by reference to statistical data, obtained from sources other than the licensees and which reflect contemporary patterns of music use. These can include sales charts, transmission logs from certain broadcasters, cinema operators, representative surveys etc.

Allocation Basis

Having processed the data from a particular provider the value of a given work can be calculated in one of two ways

Duration Basis

This method is used extensively in broadcast distributions. The net royalty for a radio station is divided by the total number of seconds of music broadcast in the distribution period to arrive at a ‘Point Value’ (the value of music per second). This ‘Point Value’ is then multiplied by the number of seconds reported by the broadcaster to calculate the royalty value for that particular song.

Example – Duration Basis

| Total Seconds of Music used by ‘Broadcaster 1’ in Distribution Period | 10,000,000 |

| Total net royalty paid by ‘Broadcaster 1’ for Distribution Period | €130,000 |

| Point Value’ (value per second) | €0.013 |

| Total duration (in seconds) reported by ‘Broadcaster 1’ for ‘Song A’. | 50,000 |

| Total royalty due to ‘Song A’ i.e. 50,000 * €0.013 | €650.00 |

Per Play Basis

This method is used most often in distributions related to live performances. The net royalty for a specific distribution pool is divided equally amongst all musical works performed.

Example – Per Play Basis

|

Total number of songs performed on a set-list |

20 |

| Total net royalty paid by ‘Promoter 1’ for that event | €1,000 |

| Point Value’ (value per play) | €50 |

| Total plays reported by ‘Promoter 1’ for ‘Song A’. | 2 |

| Total royalty due to ‘Song A’ i.e. 2 * €50 | €100 |

This document gives a comprehensive view of where each distribution technique is used across the range of IMRO’s revenue streams.

2 Broadcast Royalties

IMRO receives royalties from all Irish broadcasters. In the main the royalties from broadcasting are analysed on a Census basis where music duration is a key factor in determining the value of a royalty payment.

The process for all surveyed broadcasters is as follows.

* The Unidentified Performance file is made available to IMRO’s members and affiliates. (See Unidentified Performances section 8.2.)

2.1 Television

Television royalties are distributed by IMRO quarterly in April, July, October and December. Based on analysis of independently commissioned media monitoring data, IMRO policy is to split television royalties in the following manner:

- 85% of net revenue is distributed to the music used in general programming

- 15% of net revenue is distributed across advertising data

This split will be reviewed every 5-7 years. It was last assessed in 2011.

National Television – General

There are 6 national TV stations in Ireland: RTÉ 1, RTÉ 2, Virgin Media One, Virgin Media Two, Virgin Media Three and TG4. Each station returns complete transmission logs and these are analysed on a census basis. The royalties received from each station are distributed four times a year. A separate distribution pool is created from each station and the royalties received from that station are distributed across the music reports returned by that station.

85% of the net revenue received is distributed across ‘General Music’ i.e. the music used within all TV programmes, promos etc.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| RTÉ 1 TV – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| RTÉ 2 TV – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media One – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Two – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Three – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| TG4 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Sports – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media More – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Sports Extra – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Annually in October |

| Virgin Media Four – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Annually in October |

National Television – Advertising

15% of the revenue in each station is reserved for an ‘Advertising Music’ pool as the music returns for adverts are processed separately.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| RTÉ 1 TV – Advertising Music – 15% of Net Revenue | Census | All are calculated on a duration basis | Quarterly. April, July, October & December |

| RTÉ 2 TV – Advertising Music – 15% of Net Revenue | Census | All are calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media One – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Two – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Three – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| TG4 – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Sports – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media More – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Virgin Media Sports Extra – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Annually in October |

| Virgin Media Four – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Annually in October |

There are very few indigenous cable-only stations in Ireland. Where economically feasible, IMRO’s policy is to distribute royalties on a census basis.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Setanta – General Music – 85% of Net Revenue | Sample | 2 day per month sample. Calculated on a duration basis | Quarterly. April, July, October & December |

| Setanta – Advertising Music – 15% of Net Revenue | Sample | 2 day per month sample. Calculated on a duration basis | Quarterly. April, July, October & December |

| Premier Sports – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Premier Sports – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Freesports | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Vodafone TV | Census | Calculated on a duration basis | Annually in October |

Cable Re-Transmission

IMRO licenses cable operators and satellite broadcasters for the cable re-transmission of foreign stations in Ireland. IMRO passes the royalties it collects for these stations to the society in the territory of original broadcast e.g. the royalties collected by IMRO for the re-transmission of BBC channels is passed to PRS which is then added to the main BBC PRS pools.

The following is a selection of channels licensed by IMRO where the royalties are distributed by the societies in the original territory.

| BBC HD | Nick Jnr | Sky Sports 3 | Film 4+1 | Sky Movies Sci Fi/Horror |

| BBC1 | ITV1 | Sky Sports 1 | E4 | Sky Movies Comedy |

| BBC2 | ITV2 | Sky Sports 2 | E4+1 | Sky Movies Drama |

| BBC3 | ITV3 | Sky Sports News | Discovery | Sky Movies Indie |

| BBC4 | ITV4 | Comedy Central 1 | Sky Living | Sky Movies Classics |

| CBeebies | C4 | Comedy Central +1 | Sky Living +1 | Sky Movies Premiere |

| CBBC | Sky 1 | Comedy Central Extra | MTV | Sky Movies Premiere + 1 |

| BBC News 24 | Sky News | Sky Two | E! | Sky Movies Family |

| BBC World | Nickelodeon | Sky Three/Pick | Film 4 | Sky Movies Modern Greats |

| Box TV | Disney | BT Sport | More 4 +1 | UKTV |

As per international agreements IMRO can reserve a percentage of this Cable Re-Transmission net revenue to compensate IMRO original and sub-publishers who otherwise would not feature in the distributions in the territory of original broadcast. IMRO currently reserves 2% of net revenue to fund a Publisher Compensation Scheme.

On an annual basis, IMRO writes to its publisher members inviting them to take part in the scheme. To qualify the publisher must be able to show how it is at a financial loss due to the cable re-transmission royalties being distributed by the overseas society rather than IMRO.

The member’s earnings from IMRO’s domestic TV distributions are used to determine the share of the compensation fund. A simple weighting is also applied to reflect whether a member earns reduced or no royalties due to the overseas society carrying out the distribution.

2.2 Radio

Radio royalties are distributed by IMRO quarterly in April, July, October and December. Based on analysis of independently commissioned media monitored data, radio royalties are split in the following manner

- 85% of net revenue is distributed to the music used in general programming

- 15% of net revenue is distributed across advertising data

- For Independent Local Radio, the advertising revenue is further divided between In-House and Agency advertisements (see below)

This split will be reviewed every 5-7 years. It was last assessed in 2011.

National /Quasi- National Radio – General

There are 6 national/quasi-national radio stations in Ireland: RTÉ Radio 1, RTÉ Radio 2FM, Radió Na Gaeltachta, Lyric FM, Today FM and Newstalk. Each station returns complete transmission logs and these are analysed on a census basis. The royalties received from each station are distributed quarterly. A separate distribution pool is created for each station and the royalties received from that station are distributed across the music reports returned by that station.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| RTÉ: Radio 1 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| RTÉ: Lyric FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| RTÉ: RnaG – General Music – 100% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| RTÉ: 2FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Today FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Newstalk – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

National / Quasi – National Radio – Advertising

The advertising logs for each of these stations are processed separately. 15% of net revenue is reserved to fund each advertising distribution pool (with the exception of RnaG as it carries no advertising).

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| RTÉ: Radio 1 – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| RTÉ: Lyric FM – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| RTÉ: 2FM – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Today FM – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Newstalk – Advertising Music – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

There are 30 Regional, Multi City and Independent Local Radio stations in Ireland. The royalties received from each station are distributed four times a year. A separate distribution pool is created from each station and the royalties received from that station are distributed across the music reports returned by that station.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| 4FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| 96FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Beat 102 103 FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| C103 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Clare FM – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 3 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| Dublin’s 98 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Sunshine FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| East Coast Radio – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| FM104 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Galway Bay FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Highland Radio – General Music – 85% of Net Revenue | Sample | 2 day per month sample. Calculated on a duration basis | Quarterly. April, July, October & December |

| i102-104 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| i105-107 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| KCLR – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| KFM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Limerick’s Live 95FM – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 4 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| LM/FM – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 2 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| Midland Radio 3 – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 2 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| MWR FM – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 4 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| Ocean FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| TXPhantom FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Q102 – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Radio Kerry – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 2 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| Radio Nova – General Music – 85% of Net Revenue | Census | Census for automated returns. | Quarterly. April, July, October & December |

| Red FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Shannonside/Northern Sound – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 3 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| South East Radio – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 6 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| Spin 103.8FM – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Spin South West – General Music – 85% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Spirit FM | Sample | One month per quarter. Calculated on a duration basis | Quarterly. April, July, October & December |

| Tipp FM – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 4 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

| WLR FM – General Music – 85% of Net Revenue | Census/ Sample | Census for automated returns. 2 day per month sample for non-automated. Calculated on a duration basis | Quarterly. April, July, October & December |

Regional / Independent Local Radio – Advertising

The advertising logs for each Regional /Local stations are processed separately.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| 4FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| 96FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Beat 102 103 FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| C103 – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Clare FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Dublin’s 98 – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Sunshine FM- Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| East Coast Radio – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| FM104 – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Galway Bay FM – Music in Advertising – 15% of Net Revenue | Cenus | Calculated on a duration basis | Quarterly. April, July, October & December |

| Highland Radio – Music in Advertising – 15% of Net Revenue | Cenus | Calculated on a duration basis | Quarterly. April, July, October & December |

| i102-104 – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| i105-107 – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| KCLR – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| KFM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Limerick’s Live 95FM – Music Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| LM/FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Midland Radio 3 – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| MWR FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Ocean FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Q102 – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Radio Kerry – Music in Advertising – 15% of Net Revenue | Cenus | Calculated on a duration basis | Quarterly. April, July, October & December |

| Radio Nova – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Red FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Shannonside/Northern Sound – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| South East Radio – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Spin 103.8FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Spin South West – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Spirit FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Tipp FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| WLR FM – Music in Advertising – 15% of Net Revenue | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

Digital Radio

There are 6 digital radio stations in Ireland. As digital radio is in its infancy in Ireland and as the revenue received from this source is very modest no direct distributions take place.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| RTÉ Choice – General Music | Under Review | Currently the revenue received from this station is distributed pro-rata across the 4 RTÉ radio channels | Quarterly. April, July, October & December |

| RTÉ Junior – General Music | Under Review | Currently the revenue received from this station is distributed pro-rata across the 4 RTÉ radio channels | Quarterly. April, July, October & December |

| RTÉ Gold – General Music | Under Review | Currently the revenue received from this station is distributed pro-rata across the 4 RTÉ radio channels | Quarterly. April, July, October & December |

| RTÉ 2XM – General Music | Under Review | Currently the revenue received from this station is distributed pro-rata across the 4 RTÉ radio channels | Quarterly. April, July, October & December |

| RTÉ Pulse – General Music | Under Review | Currently the revenue received from this station is distributed pro-rata across the 4 RTÉ radio channels | Quarterly. April, July, October & December |

| RTÉ Chill – General Music | Under Review | Currently the revenue received from this station is distributed pro-rata across the 4 RTÉ radio channels | Quarterly. April, July, October & December |

At present, no advertising is carried on these stations.

Community Radio

There are a range of community radio stations and other stations that will from time to time receive temporary broadcast licenses. The revenue from these stations is distributed 50% across the RTÉ Radio 1/Lyric/RnaG General Music pool and 50% across the RTÉ 2FM General Music pools.

3 Cinema Royalties

Cinema royalies are distributed by IMRO once a year in July. Based on extensive analysis of music usage within cinemas royalties are split on the following basis

1% of gross revenue is reserved and added to the Background Music Shops & Bars pool

95% of net revenue is distributed to the music used in the relevant films

5% of net revenue is distributed across advertising data

3.1 Cinema – Mainstream

Mainstream cinema royalties are distributed on the basis of box office figures returned by Rentrak EDI. Rentrak EDI collects box-office information from all cinema operators in Ireland and compiles the official box-office charts. The relevant cue sheets are secured from IMRO’s members and from IMRO’s affiliates.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Mainstream Cinema – General Music | Census | This census is based on full annual box office figures received from Rentrak EDI. | Annually in July |

The mainstream cinema pool is made up of 90% net revenue received from all cinemas in Ireland (excluding the IFI Cinema in Dublin).

3.2 Cinema – Arthouse

Revenue from the IFI Cinema in Dublin makes up the Arthouse cinema pool. The royalties are distributed on the basis of performance logs returned by the IFI.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Arthouse Cinema – General Music | Sample | The sample is based on full annual returns received from the IFI cinema | Annually in July |

3.3 Cinema Advertising

Cinema advertising royalties are distributed on the basis of advertising logs provided by Wide Eye Media which has 100% site coverage in Ireland through all the major cinema exhibitors and through many independent operators.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Cinema – Advertising Music | Sample | Distributed on the basis of advertising logs returned by Wide Eye Media. The pool is made up of 5% revenue from both Mainstream & Arthouse cinema pools | Annually in July |

4 Live Royalties

As with broadcast royalties, IMRO strives to distribute as many live royalties as possible across actual usage data.

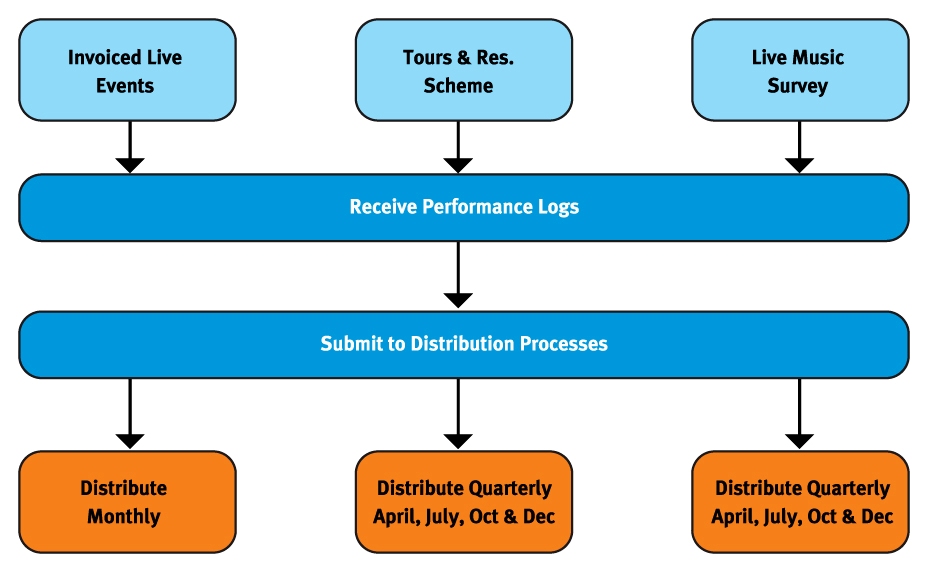

There are three main distribution pools for Live royalties. They are

- Invoiced Live Events

- Tours and Residencies Scheme

- Live Music Survey

The frequency of live royalty distribution ranges from monthly to quarterly depending on the source of the revenue.

4.1 Invoiced Live Events

Invoiced Live Events are gigs and concerts where a specific invoice has been raised for the event. On these occasions, IMRO will ring-fence the royalties collected for distribution across the actual set-lists used at the event.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Specifically Invoiced Live Events | Census | Per play basis. Generally these are larger invoiced events. 80% of net revenue is paid to the Headline Act and 20% to the Support Act/Acts.

Where more than 8 acts play at an event it is classed as a festival and the royalties are split evenly between all acts. Costs (including Classical Concerts) are calculated on the following basis; the lesser of 25% gross royalty or (Total number of bands * €158.72) + €190.46. |

Monthly |

IMRO collects set-lists from music promoters, members and sister societies. Once the set-list has been received and the invoice has been paid, IMRO distributes these royalties within a month.

If after a three year period IMRO has been unable to secure a relevant setlist, the royalties are distributed via the Live Music Survey.

From January 2015, a threshold of €24 will be applied to invoiced live events. This will result in events under this threshold being distributed via the Tours & Residencies Scheme upon submission of qualifying performances via the IMRO website.

4.2 Tours & Residencies Scheme

The Tours & Residencies scheme allows IMRO’s members and affiliates self-report all gigs they have performed in a quarter. The members and affiliates are required to submit both a Gig-List (a list detailing the date and venue of their performances) and a representative Set-List that includes all songs regularly performed.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Tours & Residencies | Self Reporting Scheme | Reported gigs receive €20 gross per venue per day within a 3 month reporting period.

Set lists and gig lists are only accepted via the IMRO website. |

Quarterly. April, July, October & December |

The deadline of submissions for inclusion in the Tours & Residencies Scheme is as follows:

| Performances | Submission Type | Submission Deadline |

|---|---|---|

| January – March | Online submissions only | Mid-May |

| April – June | Online submissions only | Mid-August |

| July – September | Online submissions only | Mid-October |

| October – December | Online submissions only | Mid-February |

From January 2012, members must submit qualifying performances via the IMRO website. A fixed cost of 10% will be applied to this scheme.

4.3 Live Music Survey

The royalties collected from all other live performances (i.e. not specifically invoiced or Tours and Residencies performances) are distributed on the basis of IMRO’s Live Music Survey. This survey of live performances in pubs, hotels & restaurants around the country is carried out on IMRO’s behalf by an independent market research company.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Live Revenue – All Other Venues | Sample | Live revenue from Bars, Hotels & Restaurants is paid based on a survey carried out by an independent market research firm. The survey is made up of 800 visits per annum to live gigs. 9 months of data is used in each quarterly distribution. Calculated on a Per Play basis. | Quarterly. April, July, October & December |

There are a number of safeguards in place to ensure the validity, accuracy and representativeness of the survey.

- The target of 800 visits per annum is set on a county by county basis (based on the number of venues in the county)

- The survey takes place throughout the year to account for seasonal changes

- Any reviewer should not see a performer more than once during any six month period

- Reviewers should not visit the same venue more than once a month

- All new reviewers are spot checked within first five reviews

- All reviewers completing over ten reviews are spot checked

9 months worth of survey data is used in any distribution period.

4.4 RTÉ Performing Groups

The RTÉ Performing Groups is comprised of the following

- RTÉ National Symphony Orchestra

- RTÉ Concert Orchestra

- RTÉ Vanbrugh Quartet

- RTÉ Philharmonic Choir

- RTÉ Cór na nÓg

Performances of these groups are licensed via annual blanket license with RTÉ.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| RTÉ Performing Groups | Census | Performances are weighted first by attendance figures and then by music duration. | Quarterly. April, July, October & December |

5 Background Music

The royalties from a range of sources for ‘background’ music is distributed over a number of different analogies. Generally background uses are made up of the public performance of Radio or Television in a premises or by mechanical means.

An analogy is a statistically sound and cost effective way to ensure that the correct mix of music is reflected in royalty payments to writers and publishers. These analogies are devised by first carrying out a survey of actual usage in the relevant type of premises e.g. Shops and Bars and then comparing the results with data already available to IMRO using an independently commissioned mathematical formula; this data will include sales charts, transmission logs from certain broadcasters etc. This comparison seeks to find degrees of similarity between the music captured in the actual survey and the data IMRO already has to hand.

The analogies are reset every 5-7 years following a fresh survey of actual usage. The Background Music analogies are next due for review in 2020.

5.1 Public Reception

This refers to the public performance of music by means of a television or radio by an IMRO customer.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Public Reception – TV & Radio | Analogy | Public Reception royalties collected for the use of TVs or Radios is added pro-rata to the relevant TV and Radio Stations (including re-transmitted cable & satellite stations where appropriate) | Quarterly. April, July, October & December |

Where an IMRO customer pays a TV tariff, the royalties are added pro-rata to all licensed television station pools (including cable re-transmitted channels) and distributed as part of the quarterly broadcast distribution.

Where an IMRO customer pays a Radio tariff, the royalties are added pro-rata to all licensed radio station pools and distributed as part of the broadcast distribution in April, July, October and December.

Where an IMRO customer pays a combined background tariff e.g. for the use of a CD player and/or a radio and/or a TV, then two-thirds of this revenue will be treated as recorded revenue and distributed on the same basis as ‘Background Music – Shops & Bars’ (see below) while one-third will be added pro-rata to all licensed television and radio station pools (including cable re-transmitted channels) and distributed as part of the broadcast distribution in April, July, October and December.

5.2 Background Music – Recorded Music

Where an IMRO customer pays a background mechanical tariff for the use of music in their business then the royalties are distributed via the Background Music analogy.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Background Music | Analogy | Background revenue is distributed on the basis of an analogy using selected radio logs, album charts and streaming chart information. | Quarterly. April, July, October & December |

| 25% – Album charts for the period. | |||

| 35% – Streaming charts for the the period. | |||

| 40% – Radio logs weighted by performances and market share. |

5.3 Sports Stadia

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Sports Stadia | Census | Calculated on a duration basis | Quarterly. April, July, October & December |

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| Airlines | Census | Calculated on a per play basis | Quarterly. April, July, October & December |

6 Digital Royalties

IMRO distributes royalties collected from a range of local MSPs (Music Service Providers). Given the emergent nature of this market and the large volume of data to be processed, general distribution policies are set but are reviewed on a case by case basis.

IMRO has partnered with a number of affiliated societies to offer licenses to multi-territorial MSPs. Furthermore, ICE Services manage licensing for online services that operate across multiple territories. They also handle the processing of usage data, which they subsequently provide to us for distribution to our members.

6.1 Music Downloads

All reported downloads from licensed MSPs are ‘auto-matched’. Unmatched downloads that have been sold three times or more will be ‘manually matched’. The total royalties collected will be distributed across all matched downloads.

6.2 Ringtones

All reported ringtones from licensed Ringtone Providers are ‘auto-matched’. Unmatched ringtones that have been sold two times or more will be ‘manually matched’. The total royalties collected will be distributed across all matched ringtones.

6.3 Music Streaming

All reported tracks that have received greater than a 200 streams in a quarter from licensed MSPs are ‘auto-matched’. Unmatched tracks that have been streamed 500 times or more will be ‘manually matched’. The total royalties collected will be distributed across all matched streams.

6.4 Video Streaming

Given the extremely high volume of data returned by licensed on-demand streaming services, it is not practical to attempt to match all data.

| Revenue Source | Analysis | Remarks | Distribution Frequency |

|---|---|---|---|

| RTÉ Player | Sample | The top 400 programmes per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the programmes. | Quarterly. April, July, October & December |

| iTunes Movies | Sample | The top 500 movies (with music titles) per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the movies. | Quarterly. April, July, October & December |

| XBox Movies | Sample | The top 100 movies (with music titles) per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the movies. | Annually in October |

| UPC TVOD (Transaction Video on Demand) | Sample | The top 100 movies (with music titles) per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the movies. | Quarterly. April, July, October & December |

| Netflix | Sample | The top 5000 titles per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the show / film. | Quarterly. April, July, October & December |

| UPV SVOD (Subscription Video on Demand) | Census | Calculated on a duration basis. | Quarterly. April, July, October & December |

| Eircom Movies | Sample | The top 100 movies per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the movies. | Quarterly. April, July, October & December |

| RTE GAA Go Player | Census | Calculated on a duration basis. | Quarterly. April, July, October & December |

| Google Play | Sample | The top 100 movies per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the movies. | Annually in October |

| RTE International | Census | Calculated on a duration basis. | Quarterly. April, July, October & December |

| hayu | Sample | The top 250 titles per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the film. | Annually in October |

| Rakuten TV | Sample | The top 100 titles per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the film. | Annually in October |

| Disney + | Sample | The top 5000 titles per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the show / film. | Quarterly. April, July, October & December |

| Disney Life | Sample | The top 500 titles per quarter are processed – per service type. Performances are weighted first by the total number of streams and then by the duration of music within the show / film. | Quarterly. April, July, October & December |

| Sony PlayStation | Sample | The top 100 titles per quarter are processed. Performances are weighted first by the total number of streams and then by the duration of music within the film. | Quarterly. April, July, October & December |

| Apple TV Plus | Sample | The top 500 titles per quarter are processed – per service type. Performances are weighted first by the total number of streams and then by the duration of music within the show / film. | Quarterly. April, July, October & December |

| Amazon Standalone | Sample | The top 5000 titles per quarter are processed – per service type. Performances are weighted first by the total number of streams and then by the duration of music within the show / film. | Bi-annually April & October |

| Sky TVOD / EST | Sample | The top 250 titles per quarter are processed – per service type. Performances are weighted first by the total number of streams and then by the duration of music within the show / film. | Annually in October |

| Amazon Prime | Sample | The top 500 titles per quarter are processed – per service type. Performances are weighted first by the total number of streams and then by the duration of music within the show / film. | Quarterly. April, July, October & December |

| Freesports | Census | Calculated on a duration basis. |

Quarterly. April, July, October & December |

This policy is kept reviewed regularly as new providers come online.

7 Royalties from Overseas

IMRO is committed to forwarding international royalties to its members in the shortest possible time. With 12 payment runs a year (January to December), IMRO is at the forefront internationally of providing the most frequent distribution of overseas royalties to its members.

All royalties received from an overseas sister society before the 20th of a given month are forwarded to our members by the 15th of the following month.

8 International Standards

IMRO is a member of CISAC (International Confederation of Societies of Authors and Composers), an umbrella group for collecting societies. As a member IMRO has signed up to CISAC’s professional rules; a code of conduct covering areas such as Governance, Membership and Transparency. In relation to Distribution, the Professional Rules set out a range of Binding Resolutions and Best Practices that IMRO fully adheres to.

8.1 Inadequate Documentation

If at the time of distribution, there is inadequate documentation for a work that has been performed or broadcast but if one of the original rights holders can be identified as belonging to one of IMRO’s affiliated societies, then all the royalties accruing to the work must be forwarded to that affiliated society. That receiving society will then be responsible for carrying out the distribution and for providing IMRO with adequate documentation for future distributions.

There is only one exception to the application of the Inadequate Documentation rule. That is where an identified original rights holder is an IMRO member. In that circumstance the royalties owing to the work will be placed in suspense and IMRO will contact its member to secure the correct documentation.

8.2 Unidentified Performances

An unidentified use is a performance that cannot be matched to any documented work by IMRO and therefore cannot be distributed via the ‘Inadequate Documentation’ rule.

In this scenario, the unidentified performances are placed on the UP File. The UP File is provided to affiliated societies in an agreed format and is also made available to IMRO’s members via the secure member area of the IMRO website.

IMRO members who log-on to the website can search for any works that they believe were performed but have not received a payment for. Each unidentified performance on the UP file holds a notional value (the royalty it would have secured had it been identified at the time of distribution). A member can claim a performance by linking it to their relevant work and following validation by IMRO staff a payment will be made at the next available distribution.

8.3 Unidentified Commercials

Unidentified Commercials refer to advertisements with music but where the music was unidentified at the time of distribution.

In this scenario, the unidentified commercials are placed on the UC File. The UC File is provided to affiliated societies and also made available to IMRO’s members via the secure member area of the IMRO website.

IMRO members who log-on to the website can search for any commercials that they believe were performed but have not received a payment for. Each unidentified commercial on the UC file holds a notional value (the royalty it would have secured had it been identified at the time of distribution). A member can claim an unidentified commercial by linking it to their relevant work and providing supporting information e.g. clock numbers. Following validation by IMRO staff a payment will be made at the next available distribution.

8.4 Debit / Credit Adjustments

In the event of IMRO paying a work incorrectly or paying incorrect share splits on the work, then IMRO will carry out a Debit/Credit Adjustment. Following validation from IMRO staff, the royalties will be debited from the incorrect copyright owners and paid to the correct owner.

Once notified of an incorrect payment, IMRO will carry out the necessary Debit/Credit Adjustment by the next available quarterly distribution.

As per international standard, IMRO does not process adjustments for claims made more than 3 years after the original distribution.

8.5 Suspense Amounts

If at the time of distribution, there is inadequate documentation for a work that has been performed or broadcast and none of the contributors can be identified, then the royalties due to that work are held in suspense i.e. the amount due to the work is reserved for a time to enable identification of the copyright owners.

All suspense amounts are reviewed after a 6 month period to attempt to identify the correct copyright owners. Copyright owners who are successfully identified will receive a payment at the next available quarterly distribution.

If after analysis, the correct copyright owner cannot be identified, then the royalties are returned to its relevant revenue pool for future distribution e.g. if the unidentified copyright owner featured on a work played on Today FM, then that unallocated royalty would be added to the Today FM pool at its next distribution.

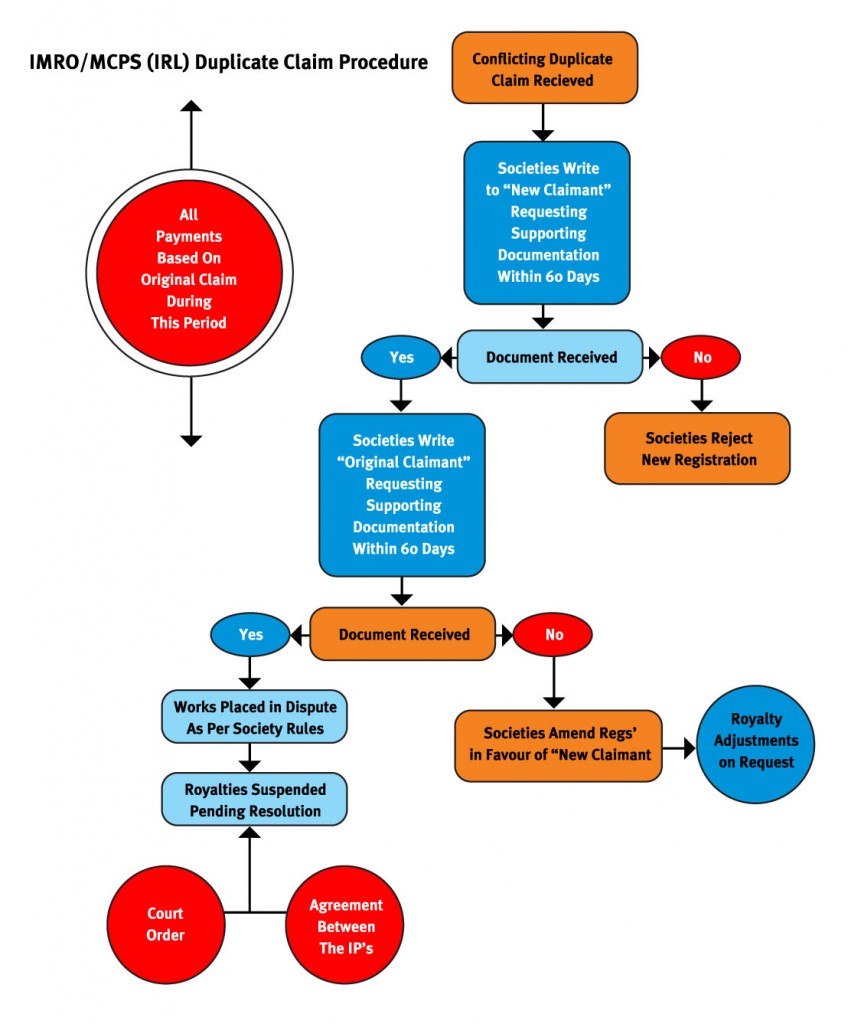

8.6 Duplicate Claims / Dispute Works

IMRO follows international best practice where counterclaims or disputes arise in relation to the ownership of musical works.

Where a new copyright owner claim conflicts with an existing copyright owner claim, then the new claimant must be able to support this claim with documentation within 60 days before that claim can be accepted by IMRO. In the meantime, IMRO will continue to pay the original claimant.

If the new claimant can document its claim, then the original claimant has 60 days to produce documentation for its claim. If the original claimant has not answered within 60 days, they will be notified that their claim has been replaced by the new claim.

If both parties maintain a claim and can supply supporting documentation, then either party can seek to have the works placed in dispute and the relevant shares suspended pending agreement. As per IMRO Rule 6, Board approval is required to place a work in dispute.

IMRO does not and will not arbitrate in the matter of disputes between interested parties and it is not IMRO’s responsibility to determine which of the claimant’s documentation is more correct or valid.

Document Control

IMRO Distribution Department

IMRO Licensing Department

IMRO Finance Department

IMRO CEO

IMRO Distribution Committee

IMRO Board

These policies were approved on the following dates:

| Date/Time | Body | Note | |

|---|---|---|---|

| 02/12/2010 | IMRO Board | Revised ‘Census/Sample’ definition. | |

| 03/05/2011 | IMRO Board | Revised RTÉ TV & Radio policies; changes to cinema policies to use Rentrak EDI & Carlton Screen Advertising data; new Video Streaming policy. | |

| 14/09/2011 | IMRO Board | Revised RTÉ Performing Groups policy. | |

| 30/11/2011 | IMRO Board | Revised Tours & Residencies scheme; revised cable re-transmission policy; creation of ILR Agency Ad policy. | |

| 14/03/2012 | IMRO Board | Revised Music Streaming and RTÉ Player policies. | |

| 20/12/2012 | IMRO Board | Revised policies increasing distribution frequency for TV, Radio, Live, Background Music and Overseas Payments | |

| 20/02/2013 | IMRO Board | New policies for Spirit FM, Setanta Sports, iTunes Movies, X Box Movies | |

| 19/06/2013 | IMRO Board | Revised Cinema policy and various updates | |

| 18/09/2014 | IMRO Board | New policy for UPC TVOD | |

| 26/11/2014 | IMRO Board | Introduction of threshold for invoiced live events | |

| 17/09/2015 | IMRO Board | New policy for UPC SVOD, Netflix and UTV | |

| 16/09/2016 | IMRO Board | New policy for Eircom Movies, Google Play, GAA Go Player | |

| 16/09/2016 | IMRO Board | Revised Clare FM Advertising Policy | |

| 11/04/2017 | IMRO Board | Revised Independent Local Radio policies | |

| 12/06/2019 | IMRO Board | New Policy for Aer Lingus | |

| 19/02/2020 | IMRO Board | New Policies for Premier Sports, Virgin Media Sports & Aer Lingus TV | |

| 07/05/2020 | IMRO Board | New Policies for RTÉ International & Freesports | |

| 10/06/2021 | IMRO Board | New Policies for Disney Life, Disney+, Rakuten, Hayu | |

| 04/05/2023 | IMRO Board | Vodafone TV, Virgin Media More, Virgin Media Sports Extra, Virgin Media 4, Invoiced Live Events | |

| 14/09/2023 | IMRO Board | Amazon Standalone, Sky TVOD / EST |

in this section…

Music Creators

- Affinity Schemes

- Join IMRO

- Benefits of IMRO Membership

- IMRO Mobile App

- Members’ Handbook

- About Copyright

- Royalty Distribution Schedule

- IMRO Distribution Policies

- Competitions & Opportunities

- Travel Grant Form

- Irish Radio & Useful Contacts

- Other Music Bodies in Ireland

- Affinity Schemes

- Music Creator FAQs

- International Partners

- International Touring Guide

Music Users

- Do I Need a Licence?

- Sign Up for a Music Licence

- Pay Your Licence Online

- IMRO and PPI Tariffs

- Dual Music Licence Explained

- Music Licences for Businesses

- Music Licences for Live Events

- Music Licences for Broadcast & Online

- Music licences for Recorded Media

- Music Services B2B

- Music User FAQs

- What’s Your Soundtrack Campaign

- Terms & Conditions for IMRO Events Voucher Competition

- Cookie Policy

- Privacy Statement

- Disclaimer

- www.imro.ie

- Terms & Conditions

- © IMRO 2024

- Registered Number: 133321

Please select login

For Songwriters & Publishers

For Business Owners